Strong June Jobs Report Reinforces Fed Caution

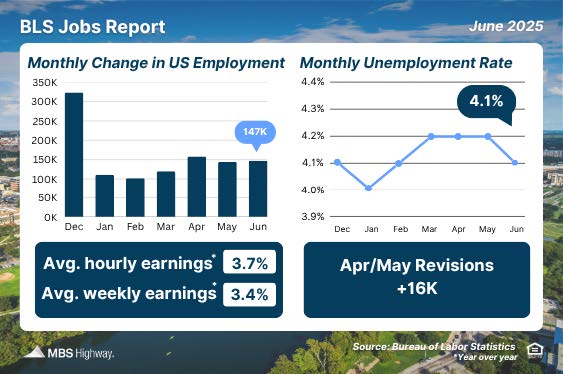

June’s Jobs Report from the Bureau of Labor Statistics came in stronger than expected, showing 147,000 jobs added last month– well above the 110,000 forecast. Positive revisions also added another 16,000 jobs to the April and May totals combined, a notable change from recent downward adjustments.

Looking closer at the numbers, a significant portion of the gains came from government employment (+73,000), with state and local education accounting for 63,000 of those jobs. The unemployment rate also saw a slight dip, falling from 4.2% to 4.1%.

What’s the bottom line?

The Federal Reserve keeps a close watch on both inflation and employment data. Their main job is to balance keeping prices stable and achieving maximum employment. This can be tricky, especially with economic uncertainties like new tariffs in the mix. Generally, if inflation remains high, the Fed is less likely to lower interest rates. Conversely, signs of a slowing economy might lead them to consider cuts.

Given the current economic picture, policymakers have been sticking to a cautious “wait and see” approach. They’ve kept their benchmark interest rate, known as the Fed Funds Rate, steady at 4.25% to 4.5% throughout this year. (Quick note: this rate influences overnight lending between banks, which then impacts broader interest rates across the economy, though it doesnt directly set long-term rates like mortgages.)

The Fed’s future decisions will continue to depend on incoming economic data. They’ve often pointed to a solid job market as a key reason for their current cautious stance. While we are starting to see some signs of cooling in the labor market (more on that below), the stronger-than-expected June report reinforces the likelihood that the Fed will maintain its cautious approach and keep rates steady at their next meeting later this month.