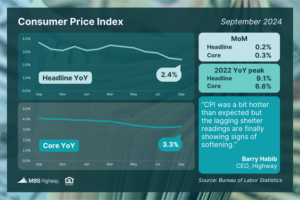

The latest Consumer Price Index (CPI) showed more progress on headline inflation, as consumer prices rose 2.4% for the 12 months ending in September. While this was hotter than expected, it does mark a slowing from August’s 2.5% annual gain and the lowest reading since February 2021.

The latest Consumer Price Index (CPI) showed more progress on headline inflation, as consumer prices rose 2.4% for the 12 months ending in September. While this was hotter than expected, it does mark a slowing from August’s 2.5% annual gain and the lowest reading since February 2021.

The core measure, which strips out volatile food and energy prices, increased 0.3% from August, coming in above estimates. The annual reading ticked higher from 3.2% to 3.3%.

Transportation costs, including airline fares and motor vehicle insurance, were key reasons for the pricing pressure that was seen last month. The monthly reading for shelter was encouraging, as it showed signs of softening.

What’s the bottom line? We are seeing progress in consumer inflation, albeit slowly. For example, if we annualize the last three months of readings, the year-over-year rate of inflation would be lower, coming in at 2.1% for Headline CPI and 3% for Core CPI.

Plus, September’s low shelter reading is an important development as it may be the first sign that the shelter component in CPI is finally catching up to market rents. Given that the shelter component makes up nearly 46% of Core CPI, lower shelter readings will make it much easier for inflation to make progress towards the Fed’s 2% target over time. The Fed also acknowledged ahead of the report that they were expecting shelter readings to moderate.