Inflation Update: Key Measure Slightly Higher Than Expected

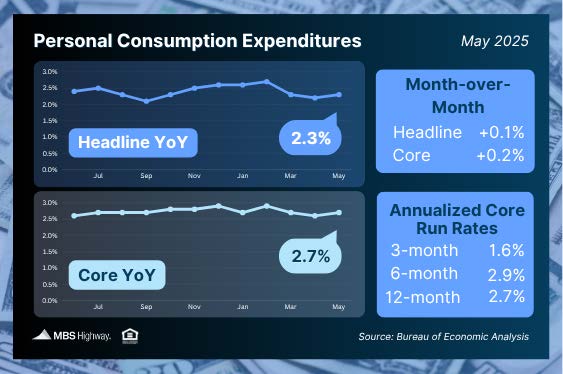

The latest Personal Consumption Expenditures (PCE) report, a crucial gauge for inflation, showed headline prices rose just 0.1% in May, bringing the annual rate to 2.3%. These figures were mostly in line with forecasts. However, the focus is often on Core PCE. This measure strips out volatile food and energy costs and is the Federal Reserve’s preferred inflation metric. Core PCE increased 0.2% in May, coming in slightly above the 0.1% forecast. On an annual basis, Core PCE now stands at 2.7%, just above the 2.6% expected. A major factor keeping Core PCE elevated remains shelter costs, which make up a significant 18% of the index. While official government data shows slow improvement, real-time market data (like from Zillow and Apartment List) suggests rents are softening faster than the official numbers currently reflect.

What’s the bottom line?

Making further progress toward the Fed’s 2% goal for Core PCE might be challenging in the near term, potentially until early 2026. Here’s why: The monthly Core PCE figures from June through December 2024 that will drop out ofthe 12-month calculation over the coming months were already relatively low (ranging from 0.1% to 0.29%). This makes it harderfor upcoming monthly price changes to significantly lower the annual rate.

Looking ahead, the picture could improve in 2026. The monthly figures from January and February 2025 that will drop out next year were higher (0.34% and 0.48%). Replacing these higher numbers with potentially lower monthly increases should make it easier to see faster progress toward the 2% target.